Material Price Movements to June 2023

12

JULY 2023

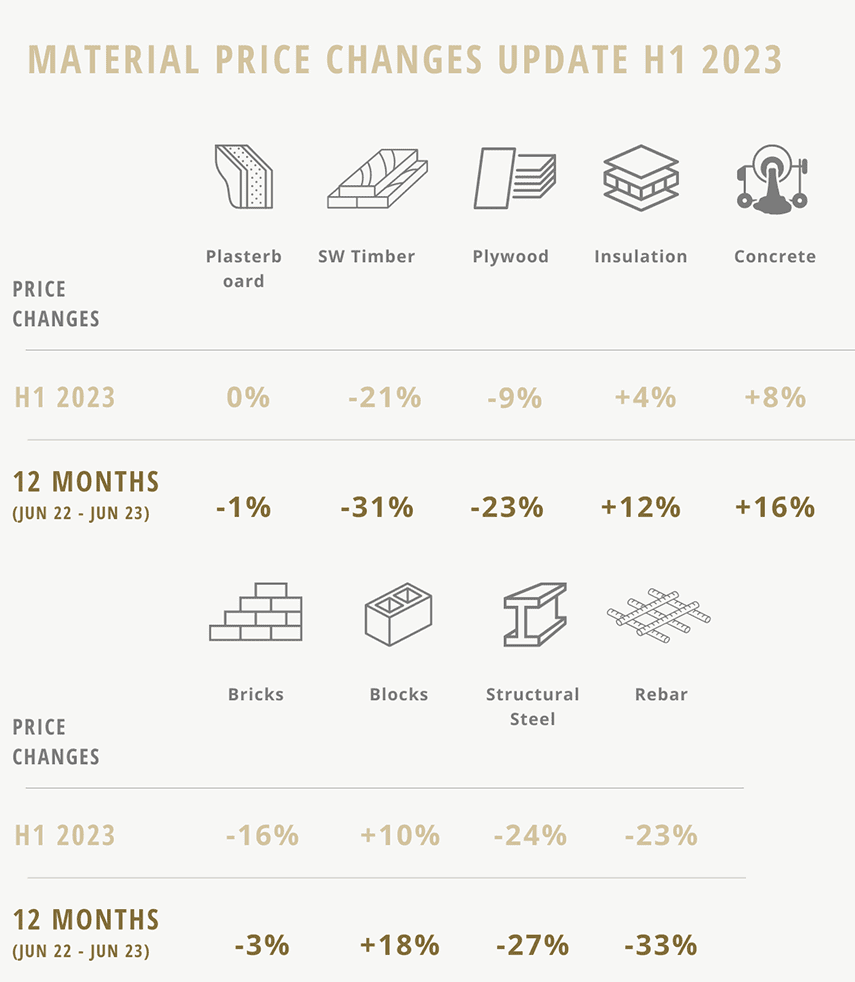

The shipping industry appears to have returned to a level of normality with average costs (40ft container) down 34% this year and at their lowest point in over 3 years. Crude oil is down 9% in 1H 2023 which is a return to levels seen in summer 2021. Natural gas has returned to the same levels seen June 2021 (down 70% in last 12 months).

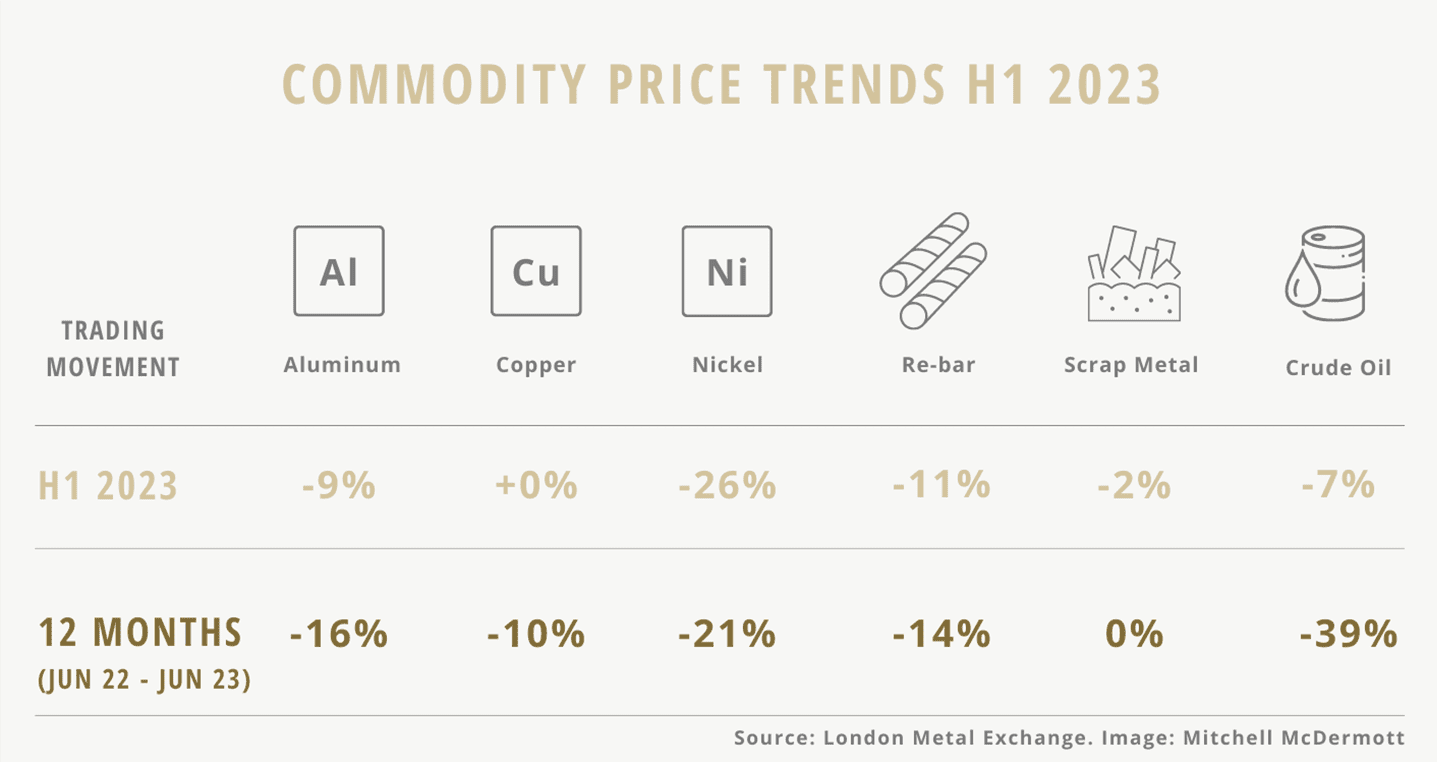

All major commodities (aluminium, nickel, copper, re-bar) have continued to recede with double digit reductions since June 2022.

Steel / Rebar

Commodity trending at its lowest level in over 2.5 years. This is reflected in re-bar wholesaler pricing which is down c. 20% in the 1H 2023. Falling scrap rates, reduced energy costs and improved stockpiles have helped this downward push.

Concrete Products

Increases in March by major suppliers has resulted in concrete seeing 8-10% of an increase in 2023 and is now 40% more expensive than Q1 2020. Further price increases cannot be ruled out and the concrete levy is yet to come in the Autumn.

Plywood / SW Timber

Positive trends on timber (-31%) and plywood (-23%) in the 12 months to June 2023. Supply has improved which has helped push down prices so far this year. As focus is shifting to more sustainable products, growing global demand for timber could impact future price trends.

Insulation

Along with concrete products, continues to face upward pressures albeit at a much slower rate than 12 months ago. 2022 saw more than a 20% increase, which is far removed from the c. 2% increase in 1H 2023.

Plasterboard

Little to no change in 2023. Energy prices and demand vs. supply will dictate any cost changes as we head into the winter months.

Bricks

Another material with downward movement in 1H 2023, with reductions of 15+% from some manufacturers. Whilst these reductions are welcome, the average cost of brick remains some 35% above January 2022 price levels. Expected to remain stable in Q3 but the energy situation will determine any movements in the winter.

If you’d like to have a chat on any further information covered please don’t hesitate to contact us.

You can view our previous newsletter narratives on Material Price Increases in our December 2022, October 2022, June 2022, March 2022, November 2021, and July 2021 posts.