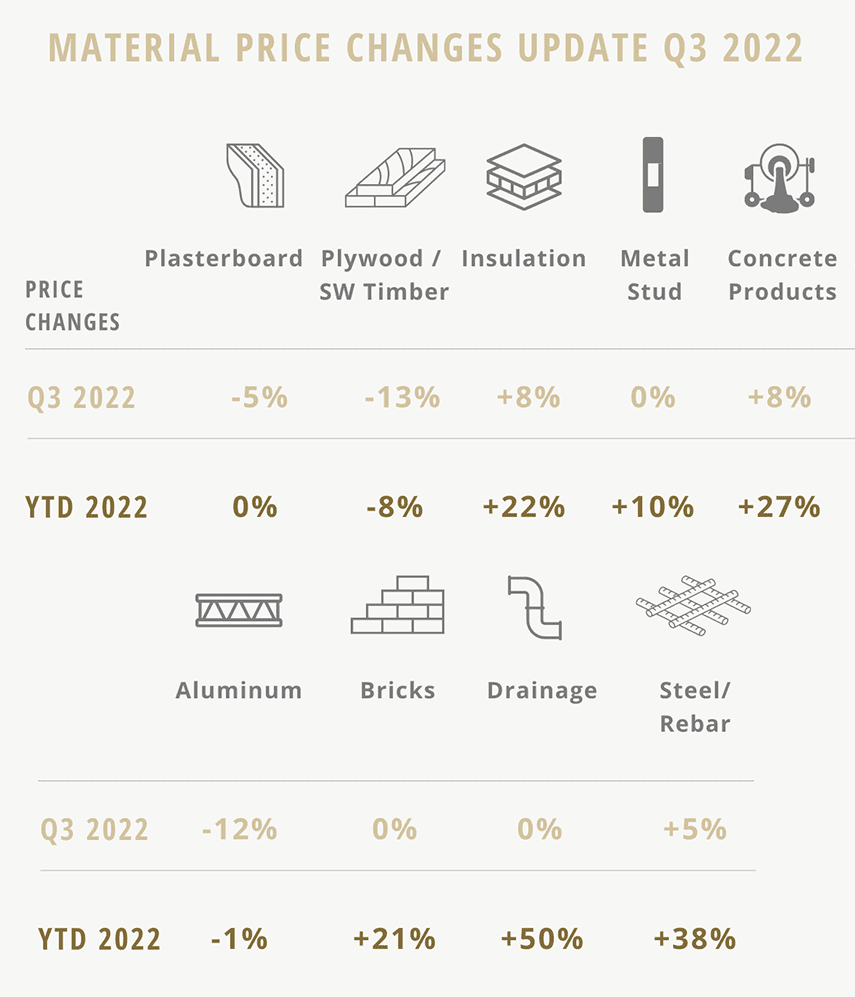

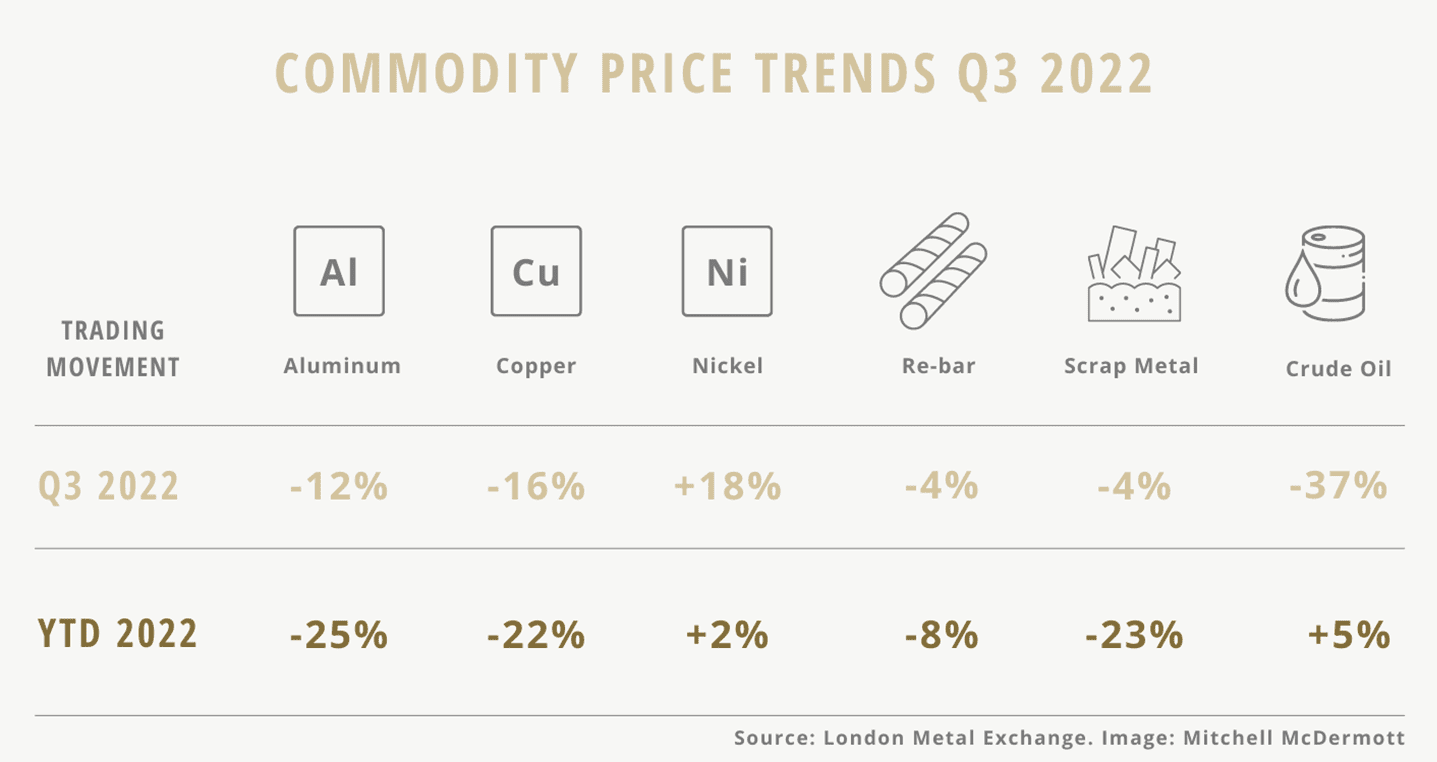

Snapshot – Material Price Movements to Sept 2022 – “Steady as we go”

30

SEPTEMBER 2022

Inflation Update

As we approach the final quarter of the year, we are seeing stabilisation across a lot of materials which provides some comfort on the back of significant increases experienced over the last 15 months.

This is largely down to macro-economic factors. Key commodities appear to be settling from the frenzy triggered by the outbreak of the war in Ukraine, and some weakening in the US market is freeing-up supply of certain materials (i.e. timber) to the European market. Shipping costs are easing with average freight costs for a 40ft container down over 35% in 2022.

The positive trends on commodities is being countered by the upward pressures on energy pricing, hence we have not seen the same level of drop-off in the material prices.

Material Commentary

Steel / Rebar

Commodity pricing has continued to soften in Q3. Energy costs and strong market demand is keeping supply and install rates above pre-Ukraine war levels.

Aluminium

Commodity price continues to recede from the March 2022 peak. Pricing has returned to Q4 2021 levels.

Concrete Products

Further price increases introduced by major suppliers in September across concrete and associated products. On-going pressure on energy costs expected to put upward pressure on prices.

Plywood / SW Timber

Plywood has seen a double digit reduction in the last quarter and SW timber has seen a lesser yet notable reduction also. More availability to the market due to a slightly weaker US economy is helping on this front.

Insulation

As expected increases in Q3 due to energy costs. Further increases cannot be ruled out.

Plasterboard

Relatively stable since the beginning of Q2, despite several suppliers indicating potential increases in Q3.

Metal Stud

Remains stable with raw material cost easing, negated by energy costs.

Bricks

Remained stable in Q3 of 2022. Manufacturers will be monitoring energy costs and with major adjustments potentially passed on.

Drainage

Flatlined in the last quarter although at a high point. Further changes dependant on energy and fuel prices.

Budget 2023 – Concrete Levy

On the back of the government’s announcement to introduce a levy on concrete products in April 2023, we have carried out an analysis to understand the impact on construction costs for typical residential units.

- 3 Bed semi-detached house – range of €800 – €1,200 per unit

- Average apartment (including parking) – range of €700 – €1,100 per unit

These costs are subject to change depending on the structural solutions adopted. The costs include site works and the average apartment costs assume 1:1 car parking. The costs exclude; VAT, Soft costs, Other development costs, Inflation.

If you’d like to have a chat on any further information covered please don’t hesitate to contact us.

You can view our previous newsletter narratives on Material Price Increases in our June 2022, March 2022, November 2021, and July 2021 posts.