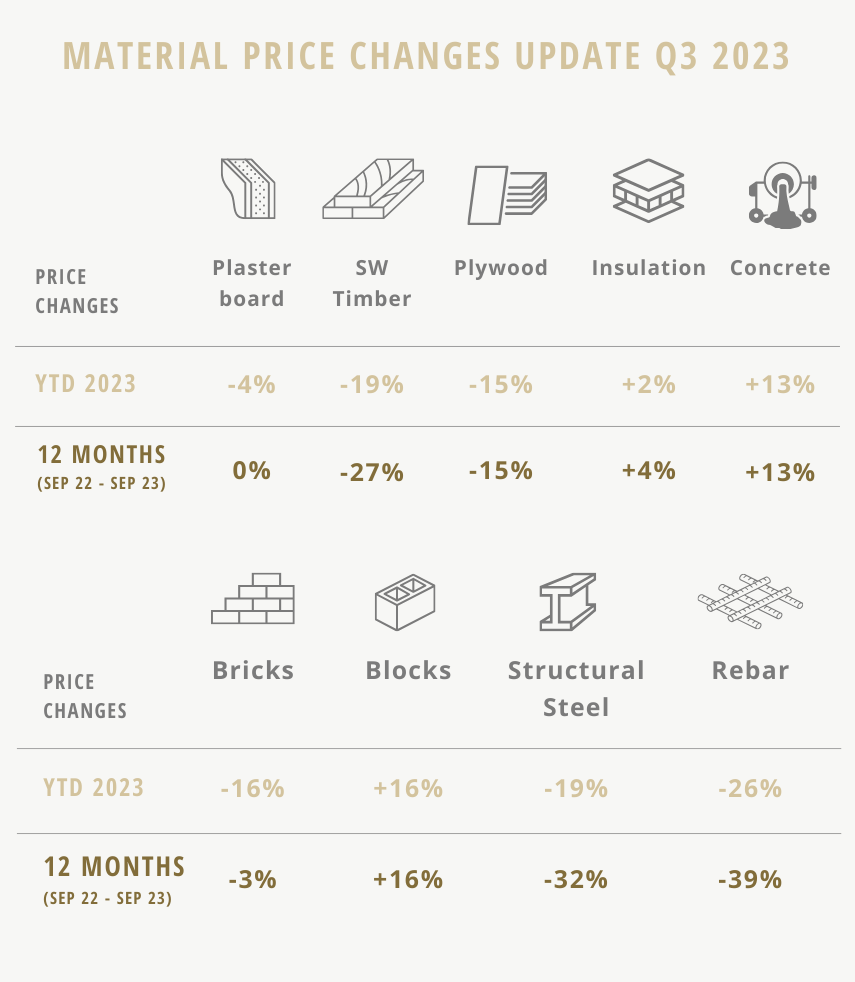

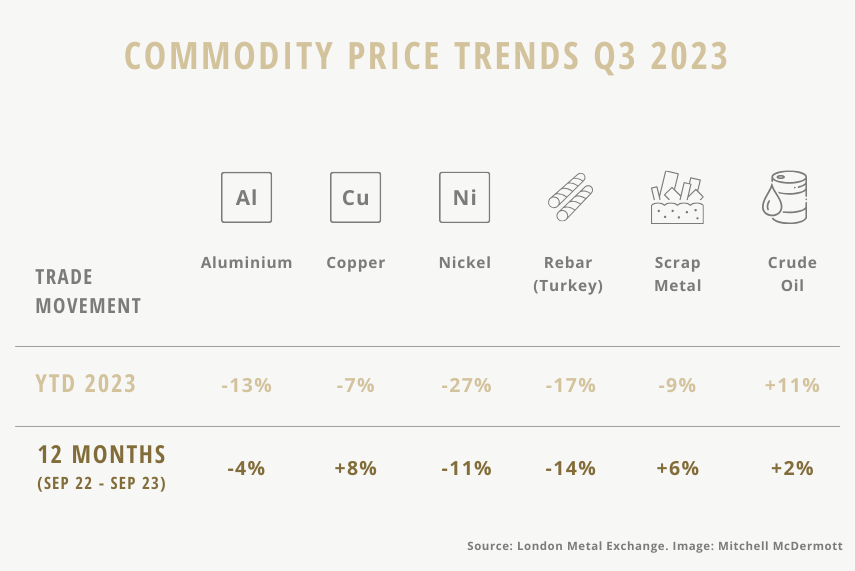

Material Price Movements to Sept 2023

28

September 2023

Overall construction cost inflation was circa 2-3% in the first half of 2023 compared to 6.8% for the same period in 2022. Based on current forecasts, overall inflation for 2024 is expected to be 4 to 5%.

Softening of shipping costs, down 64% in 12 months, and natural gas import price, down 80% over the same period, is helping to ease pressure on construction costs. Crude oil reached a low point of USD 71 per barrel in mid-June but has increased by on average 22% over the last quarter.

All major commodities are trading below levels in 2022 with double digit reductions in aluminium, nickel and re-bar.

Steel / Rebar

Wholesale reinforcement is down on average 39% in the last 12 months. Whilst demand remains relatively high, supply is less of an issue than 2022. Re-bar commodity is trading at its lowest level in 3 years. Scrap has been stable for almost 15 months but there are early indications that it is on the rise.

Concrete Products

Subject to two main price increases in 2023. First increase in March (suppliers cited energy costs) and most recently the increase due to the concrete levy on poured concrete and concrete blocks. Concrete products are one of the few areas which continues to be trending upwards with 13% in 2023 and 44% since January 2022.

Plywood / SW Timber

Positive trends on timber (-27%) and plywood (-15%) in the 12 months to September 2023. Both have been on a downward trend since January. SW timber is back to within 10% of January 2021 prices.

Insulation

Largely flatlined to date in 2023 compared to the 20%+ increases in 2022.

Plasterboard

Largely flatlined with some reduction in most recent quarter. Prices are back to January 2022 prices levels.

Bricks

Largely flatlined in the third quarter after notable reductions in the first half of the year. Wholesale prices remain c. 17% higher than January 2022. Energy prices in the next quarter will determine any price movements in the next 3 to 6 months.

If you’d like to have a chat on any further information covered please don’t hesitate to contact us.

You can view our previous newsletter narratives on Material Price Increases in our June 2023 December 2022, October 2022, June 2022, March 2022, November 2021, and July 2021 posts.