Material Price Movements Q4 2025

16

December 2025

Inflation Update Q4 2025

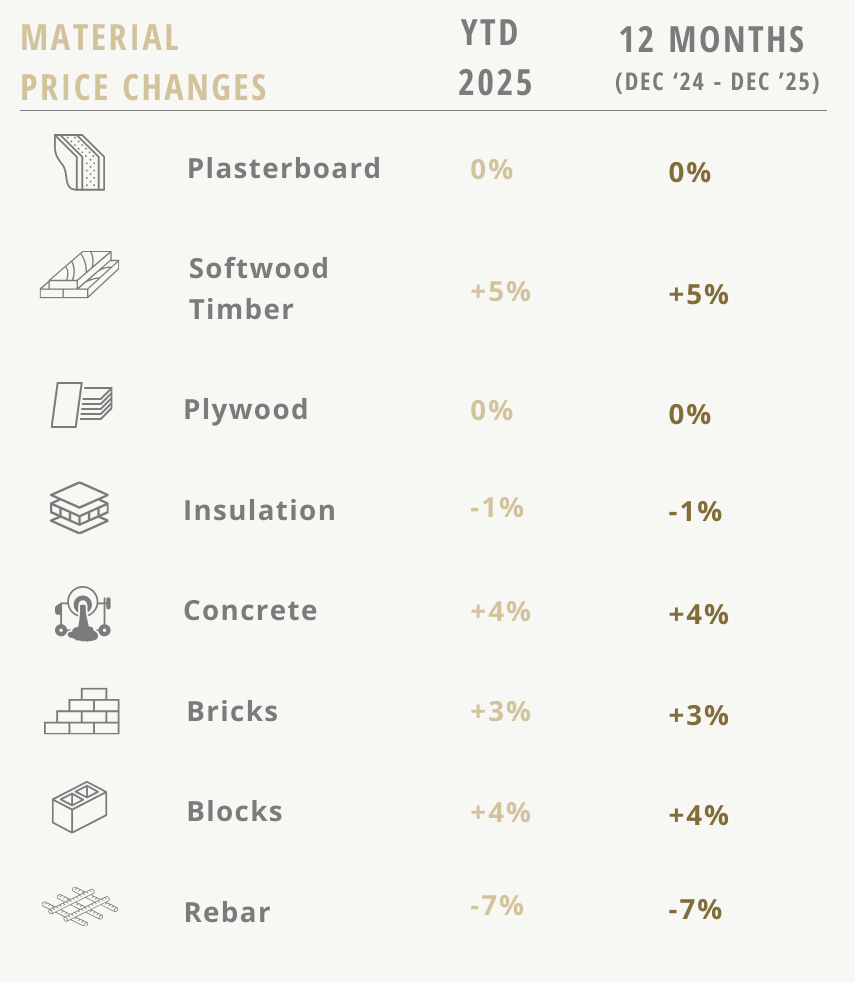

Throughout 2025, pricing across most core materials has remained relatively stable, with the majority experiencing movements of less than 5%. Insulation prices have seen a modest decline; however, this appears to be an isolated adjustment rather than an indicator of a broader downward trend.

Several suppliers have advised the market of price increases scheduled for January, generally within single-digit percentage ranges.

There has been strong upward momentum across most non-ferrous metals in 2025. Copper, aluminium, tin, and zinc have all recorded notable gains, with tin and copper particularly significant, showing three-year growth of approximately 65% and 37% respectively. In contrast, nickel continues its prolonged decline, while lead prices have remained largely stable. Steel prices have remained relatively flat throughout 2025.

From an energy perspective, both crude oil and natural gas have experienced substantial reductions over the past 12 months. Crude oil is down approximately 19% year-to-date, while natural gas prices have fallen by around 71% compared to December 2022 levels.

Shipping costs have also declined sharply over the past year, helping to reduce landed material costs, although they remain above levels observed two years ago.

Note: All commentary and data are accurate as of 5 December 2025.

Interested in looking back at previous price movement trends?

You can view our previous newsletter narratives on Material Price Changes on our Insight Archive page.

If you’d like to have a chat on any further information covered please don’t hesitate to contact us.