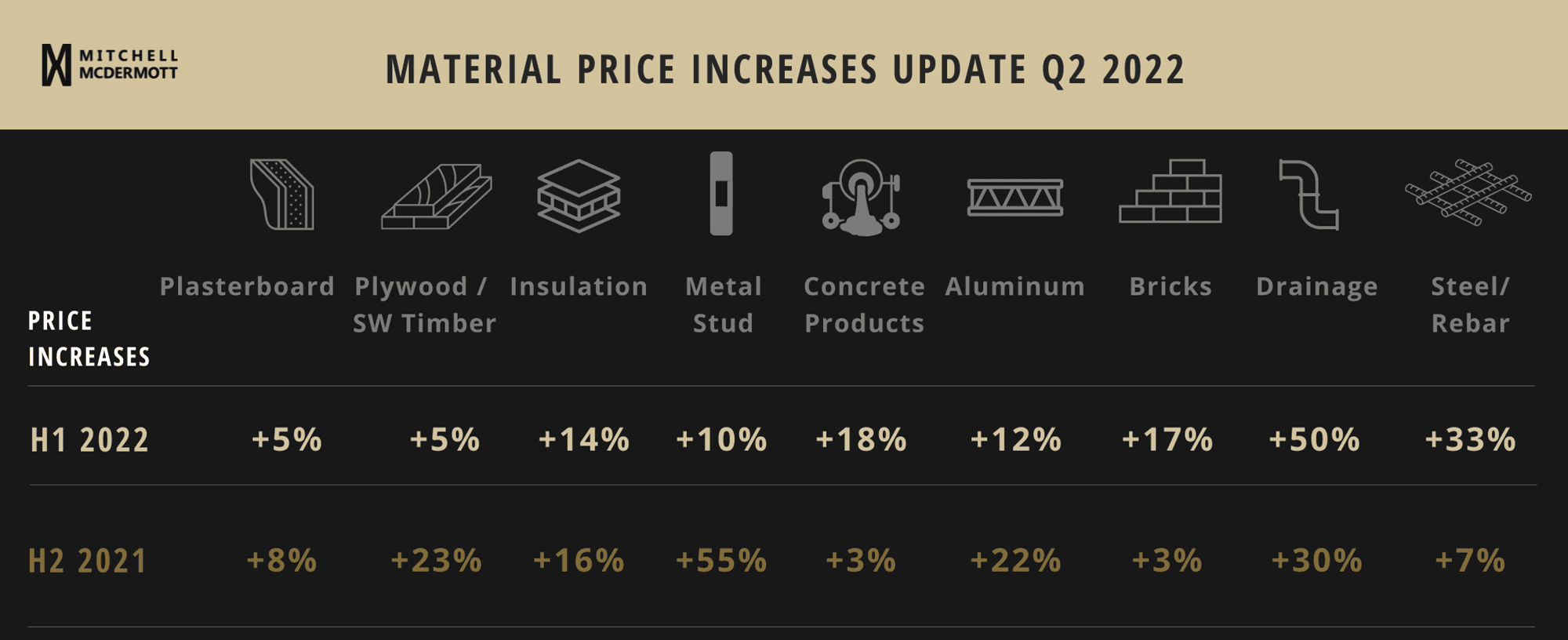

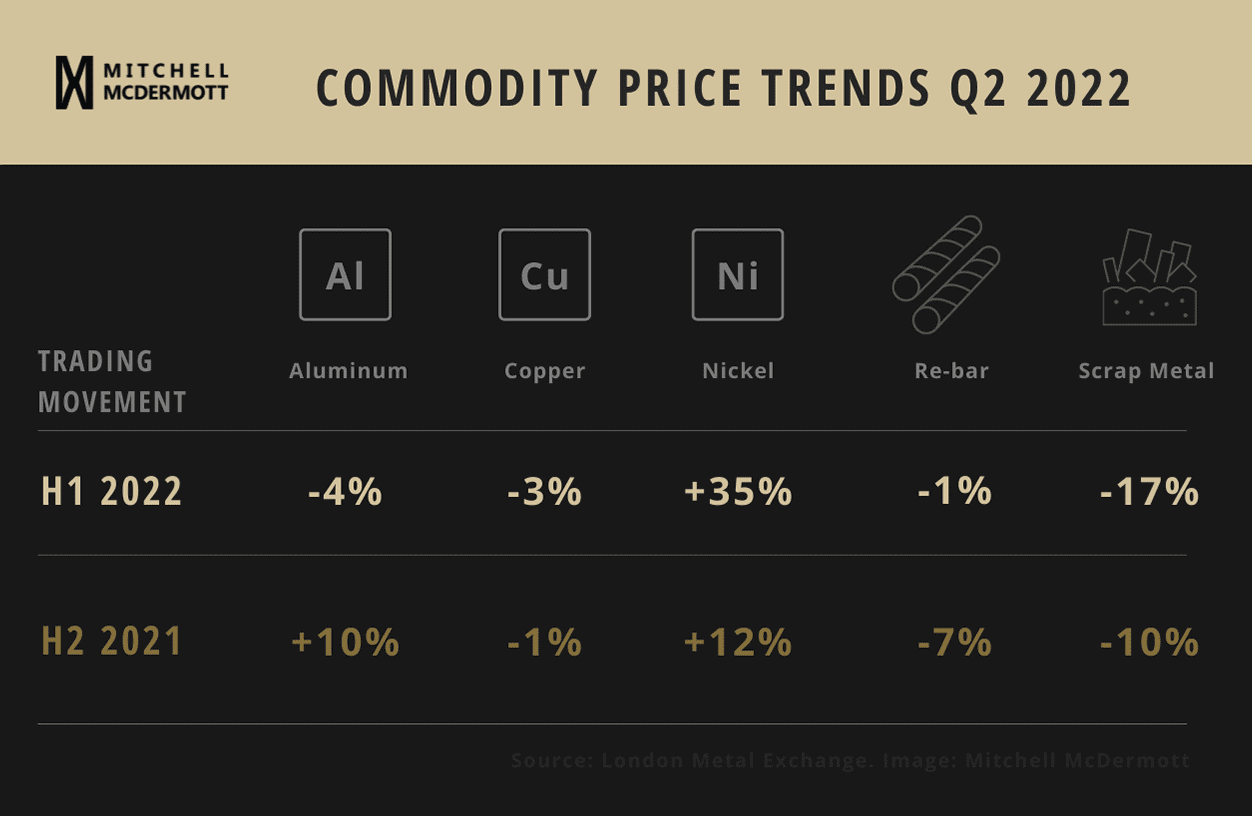

Snapshot – Material Price Movements to June 2022

30

JUNE 2022

It’s been a challenging first half of the year for the industry with lingering issues from Covid and the shock waves flowing from the events in Ukraine. Supply chains are busy fulfilling legacy orders and delivering on existing commitments all the while their input costs continue to push upwards.

However, the initial shockwaves of the war appear to be (very) slowly subsiding with green shoots in some areas. The last month has seen a cooling off on all major commodities (steel, scrap, aluminium, copper, etc.) which should translate through to material pricing.

Challenges around energy costs, shipping costs, labour shortages are likely to continue, all the while ESG targets take centre stage.

Material Commentary

Steel / Rebar

Steel re-bar is now trading at the same levels seen in late December 2021 / early January 2022 (i.e. pre-war). This is circa 30% down from the peak in March 2022. This cooling off is slowly starting to come through to material pricing, but history tells us this tends to happen slower than price spikes unless there is a significant market correction. Scrap is now trading at its lowest point since December 2020 and almost 45% lower than the peak of March.

Both of these trends would suggest positive movement on costs in the coming period but energy costs and transport will remain a challenge.

Aluminium

Recent downward trend on commodity pricing is viewed as a short term relief rather than a longer term trend. Long term uncertainty due the war coupled with rising energy costs is expected to see continued uncertainty for the 2H of the year.

Aluminium is now trading at circa 38% lower than its 2022 peak in March and at similar levels seen in November 2021.

Concrete Products

Price increases introduced by major suppliers in May across concrete and associated products. After almost 2 years of flat lining, concrete has seen 3 price increases in under 10 months. Outside of the carbon tax introduced in January this year, the other increases have been linked to increasing operating costs. No further increases have been mooted at this time but this will be linked to fuel costs.

Plywood / SW Timber

Despite energy & transport cost pressures, supply prices have remained relatively stable since the beginning of the year.

Insulation

Multiple suppliers have introduced price increases in Q2 with some further expected in Q3. Factors relating to continued pressures on input costs (chemicals, laminates, etc.) which is down to energy and transport costs.

Plasterboard

Apart from an increase in late 2021, plasterboard has been stable in 2022. Suppliers are indicating potentially up to 20%+ increases in Q3. Increased operating costs cited behind the latest notifications

Metal Stud

Relatively stable in 1H of 2022 despite raw material and energy cost pressures. No major upward movement expected in Q3.

Bricks

Upward movement linked to energy costs. Further changes will be linked to any further pressure on manufacturing and transport costs.

Drainage

Marked increases experienced already this year with any further changes dependant on energy and fuel prices.

You can view our previous newsletter narratives on Material Price Increases in our November 2021, July 2021 and March 2022 posts.