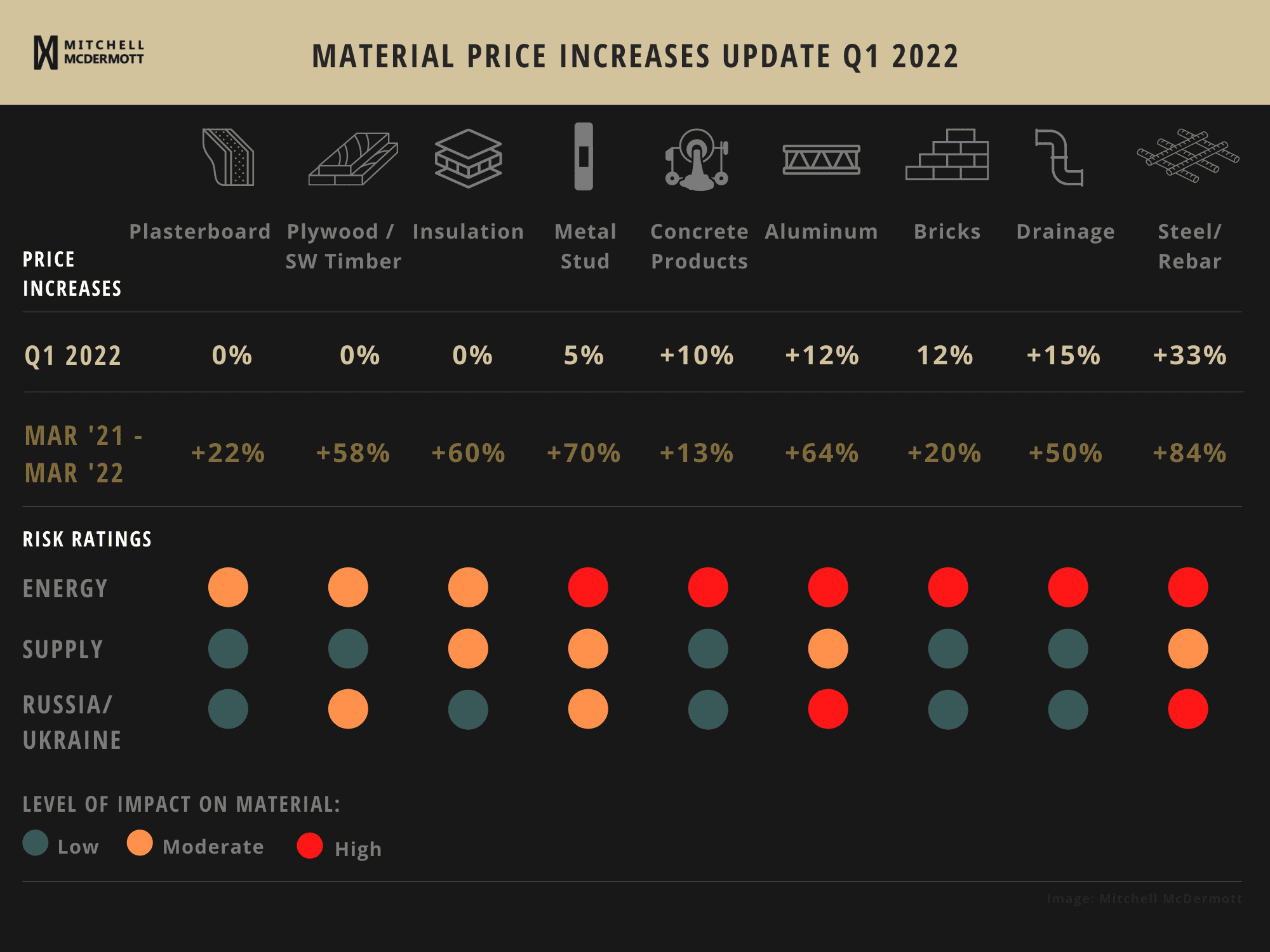

Snapshot – Material Price Movements to March 2022

31

MARCH 2022

The events of the last 24 months have had a profound impact on material prices with the majority of areas on an upward trajectory. The roll-out of vaccination programmes in 2021 allowed the gradual opening up of economies to bring some normality back to the industry but not without its challenges. The relatively quick return to construction sites was hampered by the shortage of material supply which saw significant cost spikes in mid-2021.

Fourth quarter of 2021 saw some positivity with downward movement on steel and aluminium and levelling-off of timber and insulation to name a few. There was some optimism that further decreases would come through at some point in 2022, outside of known increases coming on labour (SEO) and concrete products (carbon taxes).

Unfortunately, 2022 has, thus far, seen further increases across all the core areas. There is a combination of factors for the latest upward pressures with some lingering from the pandemic and new challenges facing global supply chains. We have identified the three most significant below;

Energy

Rising energy costs affecting all levels of the supply chain. Crude oil topped $120+/barrel in March compared to circa $60 / barrel at the same point last year. These rising input costs are forcing some energy intensive plants to slow / close production. Increased haulage / transport costs expected to be passed up the supply chain to the end-user.

Supply

Legacy demand vs. supply issues from pandemic lockdowns which has been compounded further in recent weeks due to; China lockdowns, USA demand, stuttering production, and ‘nervous’ bulk buying causing a tightening of supply. There is a potential for supply issues in certain categories in the coming months.

Ukraine / Russia

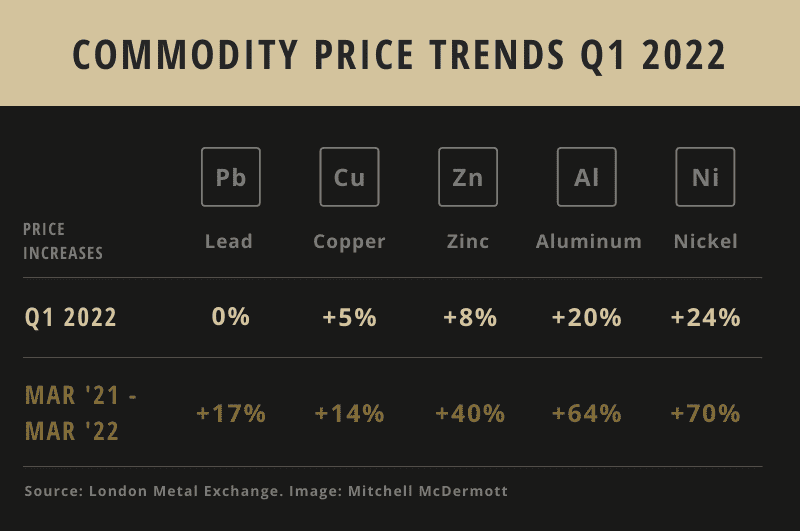

Sanctions on Russia and void left by Ukrainian exports is compounding some of the pandemic-driven issues. Uncertainty as to what the future holds is creating a volatile global market (see table for current commodity prices). While Ireland may not depend on Russian exports, there is increased demand on our traditional supply sources.

The one upshot of the challenges currently facing the industry is the necessity to review supply chains. Vendors at all levels are taking an in-depth review of where materials are sourced and how they get to their sites, with the hope to diversify sources of supply to safe guard against future disruptions.

Material Commentary

Steel / Rebar

Very volatile and will remain for some time. Production and transport costs under pressure. Potential supply issues while new supply lines are being established.

Aluminium

Commodity uncertainty due to the void left by Russia / Ukraine coupled with high demand driving up raw material cost. Rising energy costs forcing reduced production in certain locations.

Concrete Products

Q1 rises were expected with the introduction of carbon taxes. Various suppliers have mooted further increases in Q2 due to pressures on production and transport costs.

Plywood / SW Timber

An isolated dip in Q1 due to stockpile bought in Q4 ’21 is not a true reflection. Q2 increases expected due to tightened supply and transport costs. Supply issues witnessed in mid-2021 not expected in the short to medium term.

Insulation

Increasing pressure on production costs and some issues with raw material supply. Continued demand outstripping supply challenges seen in 2021.

Plasterboard

Minor concerns on the availability of paper. Mooted singled digit increases from various manufacturers by end Q2 down to production and transport costs.

Metal Stud

No marked change in Q1 but expected in Q2 due to raw material and energy price pressures. Some concerns on availability as supply lines tighten.

Bricks

Planned increases introduced in Q1 are expected to be added to due to production and transport costs.

Drainage

Legacy demand vs supply issues due to raw material shortages and price increases are impacting the production of plastic products in the EU. Tightening of supply expected for next period.

You can view our previous newsletter narratives on Material Price Increases in our November 2021 and July 2021 posts.