Mitchell McDermott InfoCards 2026 –

Key Insights

29

January 2026

Our latest suite of InfoCards is available to view or download from our InfoCards Page.

Mitchell McDermott Annual Construction Sector Report 2026 – The key points;

– Study of Fast -Track Large-scale Residential Development (LRDs)

planning applications shows very high attrition rate

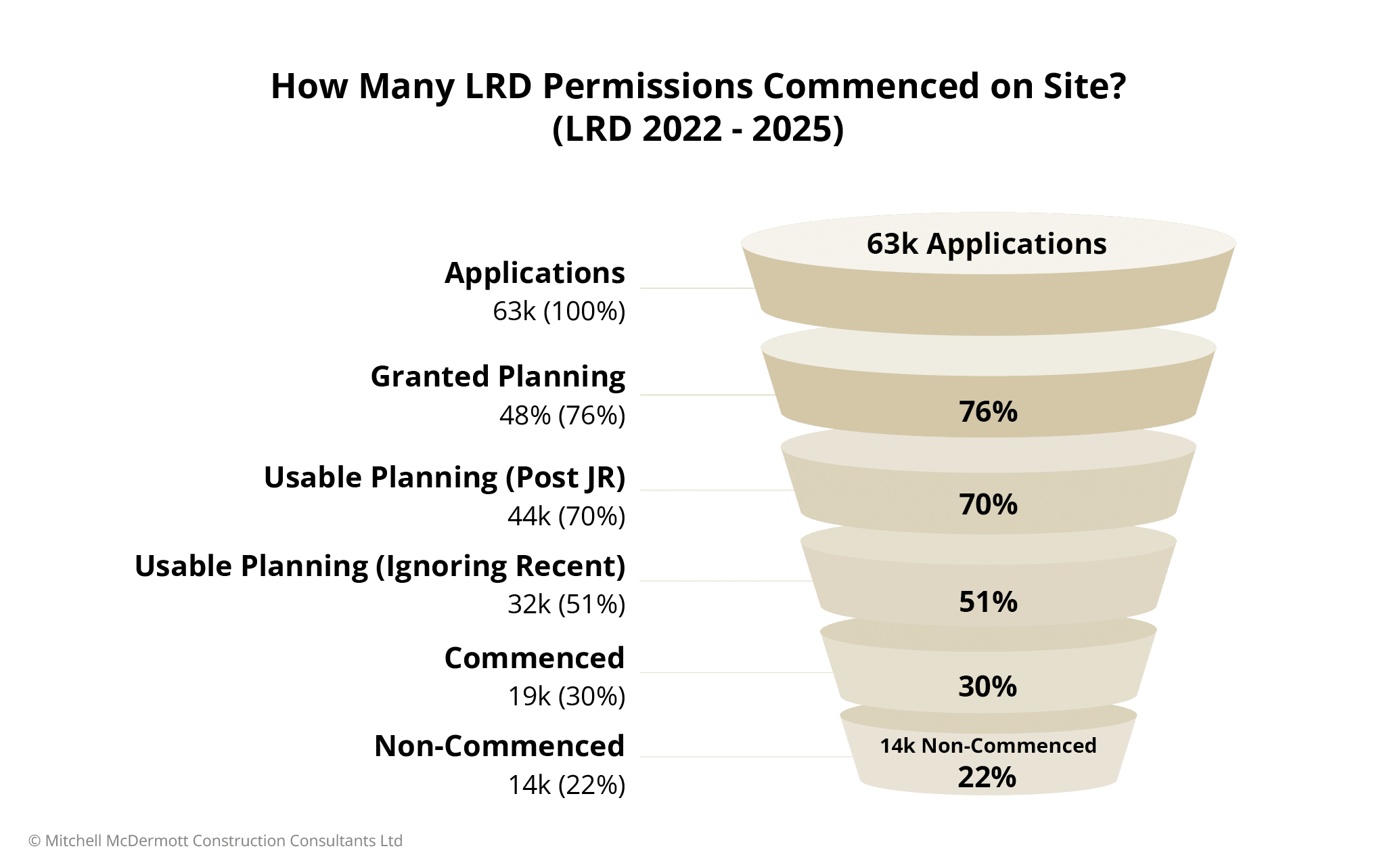

– Applications made for 63,000 units over last 4 years – but just 18,500 or 30% have started construction

– 14,000 units or 22% received planning but have not commenced

– Mitchell McDermott says figures are a “major concern” and calls on Housing Activation Office to prioritise the examination of these schemes

– Just 36,000 housing units were delivered in 2025

– SMEs and larger companies build half our LRD apartment and housing schemes

– Mitchell McDermott is calling for a two-year extension of development levies to support stalled schemes and attract the international investment Ireland needs to boost apartment construction

– Just 422 student beds will be delivered in 2026 – the lowest number in over 20 years

– “Allowing rent caps to be reset in 2026, as opposed to 2029, could generate 5,000 to 8,000 new student beds over 3 years”

– Mitchell McDermott says construction costs rose by 2% 2025

– Inflation increase of 3% to 4% is forecast for 2026

Thursday 29th January 2026 – The high attrition rate which Large-scale Residential Development1 (LRDs) schemes have experienced at the planning and commencement stages over the last four years is undermining Ireland’s ability to scale up new housing output, our analysis has found.

LRDs, make up 60 to 70% of overall planning permissions and, as a result, have a critical role to play in ramping up the country’s housing supply2.

We undertook a study of LRDs schemes from 2022 to 2025 as part of our annual InfoCard’s reporting.

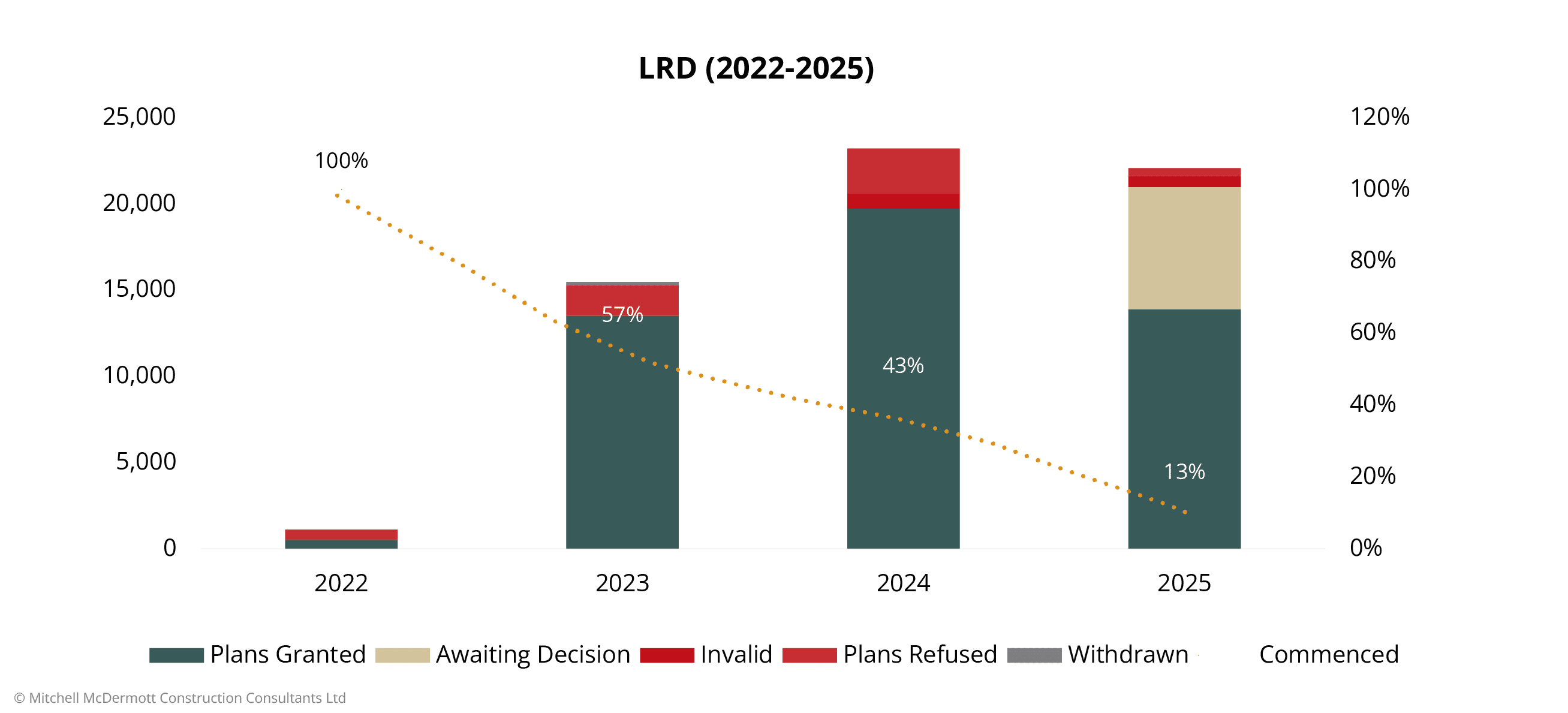

Fig 1: The percentage of Large-scale Residential Developments making it to commencement is falling.

The study – see Fig 2 – shows that while planning applications for 63,000 units were submitted between 2022 and 2025, 15,000 or 24% failed to get through the planning process. Planning for another 4,000 units (6%) was overturned by Judicial Review leaving usable planning permissions at that point for 44,000 units.

Fig 2: Between 2022 and 2025 only 30% of Large-scale Residential Development Permissions started construction.

Paul Mitchell, one of the co-authors of the report said the fact that only 30% of applications made it through to commencement over the past three years is a major concern.

“The reasons aren’t clear in all cases, but it would appear many of these schemes are in regional areas, some have viability issues and some are facing judicial reviews. Given that these schemes have planning permission, they have to be the number one target for the Housing Activation Office who should use all available state supports to help unlock them.

“The figure for the first three quarters of 2025 is 27,000 and we estimate the figure for the full year might reach 37,000. To hit our housing targets, we will need to drive this figure much higher while simultaneously ensuring that as many schemes as possible with planning are built”

Can we deliver 300,000 units by 2030?

In the report Mitchell McDermott examined what figures would need to be reached on an annual basis if this target is to be met.

Based on a straight-line model, Ireland will need to deliver 39,000 units this year. This would include 13,000 apartments (up from 11,000 last year), 20,000 houses (up from 17,000 last year) and 6,000 one-off homes.

The apartment and housing numbers would then need to rise by 17% pa over the next four years while the number of one-off homes would need to increase to 7,000 in 2028. (See Fig 3).

Fig 3: 300,000 houses by 2030 – a straight-line model.

While achieving these targets will be challenging the report notes that in the second half of 2025, the Government introduced a number of positive measures to accelerate housing delivery. These included zoning more land, adjusting rent caps, reducing the rate of VAT on the sale of new apartments from 13.5% to 9% and setting up the Accelerating Infrastructure Taskforce.

Mr Mitchell believes that while the measures taken by Government will bear fruit in time, additional targeted supports for SMEs are required.

“In recent years our PLC’s have performed strongly, building 41% of our LRD housing and apartment schemes between 2022 and 2025. But it’s vital we provide the necessary supports to SMEs and the larger companies who constructed over 50% of schemes.”

“We believe the best way to do this is to extend development levy and Uisce Eireann waivers for the next two years, while also increasing the supply of serviced sites, and providing them with equity and debt support services. We believe these time-limited supports could help unlock many schemes across the country and deliver the housing supply we so badly need.”

“As we can see in Fig 2, if we are to succeed in reaching our housing targets, we will need to ramp up apartment output significantly. As a country, we do not have sufficient resources to do this on our own and will need the support of international investors and pension funds to drive apartment development.”

Lowest delivery of student beds forecast for 2026

The report found that only 657 student beds were delivered last year down 54% on the 1,430 delivered in 2024.

Paul Mitchell said the Purpose-Built Student Accommodation sector is like a microcosm of the overall housing crisis.

“At the moment we have overall demand of 90,000 plus and existing stock of 50,000. That’s a deficit of circa 40,000. That is why we hear so many stories of students being unable to find accommodation and having to endure long commutes. There is planning for 15,000 beds but construction has halted due to viability issues. The sector has also been hit with a number of regulatory changes over the past 5 years, which have stymied development.

“It was announced earlier this week that new regulations which will allow landlords to increase the rent every three years will only come into effect in 2029. We believe this is a lost opportunity. If the government was to allow rent caps to be reset now, it would enable specialist PBSA developers to reinvest much-needed capital and embark on new development. This could generate between 5,000 to 8,000 new student beds over the next 3 years.”

“Increasing student accommodation would also help boost the overall housing supply. For example, if you say that, on average, every two students take up one housing unit, then if we built 8,000 units over the next 3 years, it would put c.4,000 housing units back into regular housing.”

Construction Inflation steady

Mitchell McDermott says commercial construction costs rose by 3% to 4% last year while apartment construction costs increased by 1% to 2%. This year we expect commercial to increase by 2% to 4% and apartment costs to increase by 1% to 2% again.

The Mitchell McDermott InfoCards are available on our InfoCards page or via the company’s app MMCD Intel.

1: A Large-scale Residential Development (LRD) is a specific category of planning application comprising 100 or more houses, apartments or student accommodation. It was introduced in December 2021 to replace the former “fast-track” Strategic Housing Development (SHD) process. It represents a shift back to a two-stage planning process, where decisions are made by local authorities rather than directly by An Coimisiún Pleanála, while still aiming to speed up the delivery of housing.

2: The remainder is made up of permissions secured under the standard planning application process (Sect 34). These include one-off housing and smaller housing and apartment schemes.

3: It is too early to apply any significance to the 13% for 2026 as a lot of the decisions have been made quite recently.