Mitchell McDermott InfoCards 2021 –

Key Insights

23

FEBRUARY 2021

*Please note the insights listed below are from our 2021 suite of InfoCards. Our most up to date InfoCards are available on our Insights Page.

Mitchell McDermott InfoCards 2021 – The key points;

– There has been a tenfold increase in the number of residential units in SHDs in Dublin quashed or held up due to judicial reviews

– While only 508 units were affected by reviews in 2019, that figure jumped to 5,802 in 2020

– Construction cost inflation is predicted to rise by up to 3.5% this year but fears that Brexit and Covid-19 supply chain bottlenecks could push this higher

– €7bn investment in data centres planned over next 5 years as offices and student accommodation slow

– Dublin will see over 4,000 new hotel beds in 2021, but most new schemes on hold.

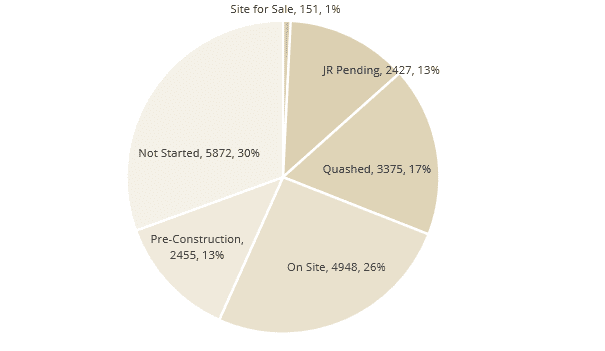

New figures show that there has been a tenfold increase in the number of residential units in Strategic Housing Developments in Dublin quashed or held up due to judicial reviews.

While only 508 units were affected by judicial reviews in the capital in 2019, last year that figure jumped to 5,802. Nationally there has been a seven-fold increase in the number of units in SHDs stalled due to judicial reviews.*

A Strategic Housing Developments (SHD) is a fast-track planning process for schemes of 100 apartments or houses or more than 200 student beds.

A report by leading consultants Mitchell McDermott found that almost 65,000 residential units have been granted planning permission under the SHD process since its introduction in September 2017.

Paul Mitchell, one of the authors of the report, described the increase in judicial reviews as a worrying trend.

“The SHD process was designed to fast track the planning process for residential units in order to alleviate the current housing supply crisis. Last year 30% of units were stalled due to the judicial process, compared to 4% in 2019. The country’s annual residential output is 20,000 units, so that puts that figure in context and shows the disproportionate effect these reviews are having on potential developments.”

Fig 1 Site Status for Dublin projects granted planning under SHD in 2020

“Currently an SHD application takes around 40 weeks. If a SHD planning permission is quashed, for whatever reason, the application has to be resubmitted to An Bord Pleanála. This will take four to six months, adding substantial costs to a development. We would like to see a more measured approach adopted whereby if permission is quashed due to relatively minor administrative issues, the applicant does not have to restart the process again.

“The SHD process comes to an end in February 2022 and there are currently no plans in place as of yet for new arrangements. This could lead to further bottlenecks in the planning system next year.”

“In regard to court actions, the threshold for taking a judicial review is quite low and we believe should be reviewed.”

Cost uncertainty and increased complexity

According to the report overall construction costs increased by 3.4% last year and are predicted to rise by between 2.5% and 3% this year. Its estimated total construction output remained unchanged at €23bn last year despite the impact of Covid. Output in 2021 is forecast to fall to €20bn. However, Mr Mitchell says both forecasts come with a number of caveats.

“In 2020 we lost 15% of the year due to Covid and at the moment it looks likely we’ll lose 25% of 2021. That is a stark figure and will have a substantial impact on total output and residential output.”

“With regard to costs, there is a lot of noise in the market at the moment about potential increases in building materials. Brexit and Covid have disrupted supply lines and as a result a range of building materials such as timber, insulation, ironmongery, plasterboard etc are predicted to rise by between 5 to 16%. The pandemic has also led to a massive 300% hike in shipping costs from Asia to Europe, adding further to cost uncertainty.”

“If there was a good time to have a supply issue it’s probably now with a lot of sites closed, but the current bottlenecks need to be addressed in the first half of the year.”

“Of course, Covid will also have a deflationary impact with the reduced pipeline of activity leading to increased competition and more competitive pricing. However, we see potential for a two-tier inflation market in 2021 with higher tender price increases on larger projects due to the smaller pool of contractors. And of course, if the supply issues aren’t sorted before construction reopens and activity levels pick up, inflation figures could be much higher.”

“One surprising element we picked up in the course of our research is that the implementation of new Covid-19 work practices due has led to increased micromanagement on sites and this has actually led to an increase in productivity by construction workers.”

Data Centres – a bright light

According to the report over €7bn will be invested in the construction of data centres here over the next five years.

The report found that Dublin is still the largest data centre market in Europe with London its closest rival among the key FLAPD group (Frankfurt, London, Amsterdam, Paris and Dublin).

Anthony McDermott, a Director of Mitchell McDermott said Ireland’s leadership position in Europe was due to its highly competitive pricing and the scale of the companies operating here.

“Eighty six percent of data centres built here are hyperscale ones where large companies such as Amazon, Apple, Facebook, Google and Microsoft build and operate their own data facilities to their own specifications.”

Dublin will see over 4,000 new hotel beds this year

While new hotel development has been hit severely by the pandemic – only 380 new beds opened in Dublin in 2020 – 4,177 new beds are due to open in the capital this year. Dublin has close to 25,000 beds in total, so that is an increase of 17% this year.

However, a lot of the new schemes that would have been due to start in 2021 are currently on hold. There are a significant number of hotels that have planning, the majority of which are in the budget hotel category. There are only one or two potential new 5-star hotels planned with most of the activity in this sector being small extensions / refurbishments.

Offices and Student Accommodation slowing

The report notes that while a number of speculative office schemes are proceeding, they are being redesigned for flexibility and incorporate new features such as contactless entrance and egress.

Mr Mitchell believes it is likely that companies will experiment with different working models and that this could continue through 2021/2 until a suitable working model is established that suits their needs.

While the market delivered circa 3,500 student accommodation units last year, the report predicts a figure of 1,600 this year. The number of new scheme commencements has certainly slowed which will impact overall supply. Mr Mitchell pointed out that a Dublin university had postponed the construction of a new 1,200 bed on-campus complex due to covid-19.

“Booking volumes from students are decreasing and the market is definitely slowing. We’re also seeing an increased preference for single rooms across Europe – possibly due to fear of infection and requirements to self-isolate.”

Ends.

* National figure. While only 1,048 units were affected by judicial reviews in Ireland in 2019, last year that figure jumped to 6,969.